India's Digital Rupee by RBI

Introduction

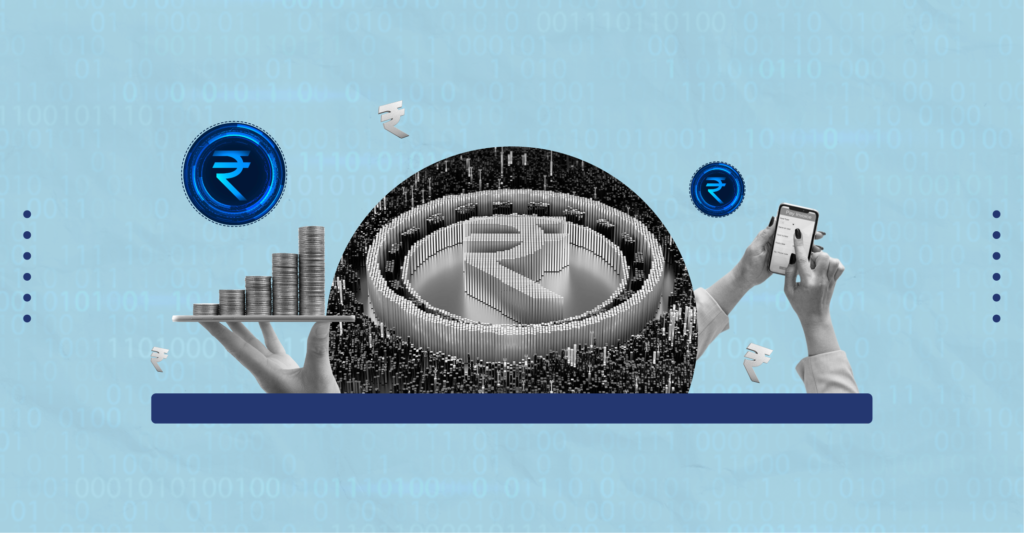

The digital rupee, or e₹, is India’s attempt at introducing its digital form of the national currency-the Rupee (₹), issued by the Reserve Bank of India (RBI). Incepted with a pilot program from December 1, 2022, the e₹ was designed to translate the advantages of physical cash-trust, safety, and settlement finality-into digital terms.

As of May 2025, it is still under testing, with pilots still being conducted for retail (e₹-R) and wholesale (e₹-W) segments, which translates the will of India to modernize its payment system and is on the global trends of digital currency. This report is meant for you as a prospective user so you understand how to use the e₹ and how it differs from the physical currency that you know.

Context for Users

The digital rupee follows a trend observed worldwide wherein central banks are attempting to develop digital currencies to keep pace with a fast-expanding digital economy. India and RBI did initiate work on the CBDC framework in 2022, with some amendments to the Reserve Bank of India Act, 1934, being introduced for the facilitation of its implementation. The pilot program proposes the retail segment (e₹-R) and wholesale segment (e₹-W) of which the retail segment targets individual consumers and businesses like yourself, while the wholesale segment targets interbanks.

Issued by the Reserve Bank of India, the e₹ is, as per Section 26 of the RBI Act, 1934, a legal tender and thus constitutes a direct liability of the central bank. It is available in denominations the same as those present in physical currency.

for familiarity and can be used for person-to-person (P2P) and person-to-merchant (P2M) transactions. Unlike UPI, which is a payment instrument, the digital rupee is a digital currency issued by the Reserve Bank of India and can serve as a store of value.

The pilot started in January 2025 and is in full force currently through 15 select banks and non-banks. You can access your e₹ wallets via apps downloadable from the Play Store or App Store. The pilot is under the purview of testing the technology, architecture, scalability, and acceptance of the digital rupee, both as an online and offline mediatory entity. The FAQ mentions that the e₹ ensures greater privacy and anonymity, maintaining regulatory oversight and conforming to a set of robust encryption standards that guarantee the security of transactions.

How to Use the Digital Rupee?

Using digital rupee is kept as simple and straightforward as possible so that even people who have just got acquainted with digital payment methods can use it. A detailed guide is given below for your consideration:

1. Download the App: Download the e₹ wallet app from the Play Store (Android) or App Store (iOS). Multiple banks, including SBI, ICICI Bank, & HDFC Bank, offer their versions of the e₹ wallet app.

- Example: For SBI, go to eRupee by SBI; for ICICI Bank, look for Digital Rupee by ICICI Bank.

2. Onboarding: Right now, a savings bank account is a must to be able to open an e₹ wallet, as it is linked for KYC purposes. But there is no minimum balance requirement for the wallet, making it accessible to you.

3. Making Transactions: Pay with your e₹ wallet by scanning the merchant’s CBDC QR code or even a UPI QR code. This makes it versatile, as you can use it at most places that accept digital payments.

- For example, if you’re buying something worth ₹15 and you pay with ₹20, the remaining ₹5 will automatically be returned to your wallet, similar to physical cash change.

4. Offline Transactions: This e₹ supports offline transactions, which is particularly useful in rural or remote areas where internet connectivity is a hit or miss. An implementation on the lines of telecom connectivity or NFC (Near Field Communication) is being explored by the RBI to make the e₹ usable even without internet access.

5. Programmable Money: The e₹ can be programmed for various purposes such as government DBT payments, employee allowances, etc. This means that a certain sum of money may be locked for a specific purpose, with parameters for its utilization such as expiration date or geo-location restrictions. It is quite apposite from a government scheme or corporate reimbursement point of view.

6. No Extra Charges: There are no charges levied for the usage and maintenance of the e₹ or an e₹ wallet, making it as economical as cash for you.

7. Support: In case you face any trouble or disputes, you can reach out to the customer support in the e₹ wallet app or to the customer care of the bank or non-bank issuing the wallet, wherever assistance is required.

How the Digital Rupee Differs from Physical Currency ?

While the main purpose of the digital rupee is to resemble the utility of the physical cash, there are a few key differences which make it unique and might offer more conveniences to you as a user. Let us then consider the exhaustive comparison:

Form and Storage:

- Digital Rupee: Stored in a digital wallet on your smartphone and requires digital infrastructure to carry out transactions.

- Physical Currency: Stored in the form of notes and coins and requires no technology for transactions.

Accessibility:

- Digital Rupee: Requires a smartphone and, for most transactions, an internet connection (though offline capabilities are available). This means you need a device, but it’s accessible in both urban and rural areas with offline support.

- Physical Currency: No technology required; you can use it anywhere, anytime, without any setup.

Transaction Timing:

- Digital Rupee: Transactions can be conducted 24/7, instantly, offering greater convenience for you, especially for late-night or emergency payments.

- Physical Currency: Limited by banking hours for deposits or withdrawals, which can be inconvenient if you need to access cash outside business hours.

Security and Trust:

- Digital Rupee: Backed by the RBI with robust encryption for transaction security, reducing the risk of loss or theft compared to carrying cash.

- Physical Currency: Relies on physical security measures (e.g., not losing cash), but it’s vulnerable to theft or damage.

Privacy:

- Digital Rupee: Offers enhanced privacy with regulatory oversight, but transactions are traceable for legal purposes, which might concern you about surveillance.

- Physical Currency: Highly anonymous, as transactions are not recorded, offering more privacy but less traceability for security.

Programmability:

- Digital Rupee: Can be programmed for specific uses (e.g., DBT, allowances), ensuring funds are used as intended, which is useful for government schemes or corporate payments.

- Physical Currency: No such feature; cash can be used for any purpose, offering flexibility but less control.

Store of Value:

- Digital Rupee: Can be withdrawn from your bank account and stored separately in your e₹ wallet, serving as a store of value, similar to cash but digitally.

- Physical Currency: Already a store of value but requires physical storage, which can be risky if lost or stolen.

Interest:

- Digital Rupee: No interest is paid on wallet balances, maintaining a cash-like feature, which means you won’t earn interest like in a savings account.

- Physical Currency: Does not earn interest either, but it doesn’t require digital infrastructure.

Environmental Impact:

- Digital Rupee: Reduces the need for printing and transporting physical notes, making it more environmentally friendly, which might appeal to you if you care about sustainability.

- Physical Currency: Requires physical production and distribution, which has environmental costs, estimated at ₹49,848,000,000 in 2017 for security printing, as per Wikipedia.

Real-World Impact for Users

There are many possible impacts to everyday financial life with the introduction of a digital rupee:

- Financial Inclusion: The e₹ will help reach populations who have limited access to traditional banking services and thereby promote financial inclusion. Its offline capability, made possible through telecom connectivity or NFC communication, etc., allows people to transact in areas with limited or no internet connectivity, which will be another advantage for those living in rural or remote regions.

- Transaction Efficiency: Payments using e₹ are instantaneous and could be made at any hour of the day or week, thus offering greater convenience and efficiency as against traditional methods of payments. This could, in fact, help you in keeping transaction costs and settlement times at a minimum level, particularly for urgent payments.

- Programmability: The e₹ could be programmed for any particular purpose such as direct benefit transfers (DBT), interest subvention, and lending. It makes the government schemes or financial services more efficient by ensuring that funds are utilized for the intended purpose, thus reducing subsidy leakage and corruption, which could directly benefit you if you are a recipient of any government subsidy.

- Reduction in Cash Usage: With increasing acceptance of technology-backed transactions, use of physical cash may further shrink, following the path of digital economies in the global arena. This would increase the safety of carrying money for you-to be stolen or lost.

- Payments Innovation: CBDC launch triggers further fintech innovation to create newer ends and means for digital currency. Banks such as HDFC Bank and ICICI Bank are offering digital rupee apps nowadays, thus paving userways for you-see HDFC Bank – Digital Rupee- Features & Benefits of E Rupee.

On the other hand, some challenges must be faced:

- Adoption: Wide use of e₹ depends on user education, trust-building, and favorable infrastructure. As of May 2025, the pilot is limited to select users and merchants, including 15 banks in participation according to the FAQ of RBI.

- Privacy and Security: The e₹ offers better privacy than most, whereas concerns about surveillance and security deposit remain. The RBI’s FAQ affirms strict cyber security architecture, whereas Forbes article experts argue about possible centralization of financial power, which may concern you.

- Technical Reliability: Make sure it is secure and reliable, especially on the basis of offline transactions, against frauds and unauthorized access; RBI is actively trying telecom connectivity as one of the solutions for offline transactions, yet so far, technical challenges could deepen distrust if left unchecked.

View of Experts on Users

Experts see the digital rupee as a step forward toward modernizing the payment system of India, but the experts differ on what it would imply for you:

Positive Views: Most experts talk positively about the e₹ in terms of financial inclusion and cost reduction in transactions. They consider offline capabilities and programmability as the key innovative features that address your needs in case you are living in rural areas or are dependent on social welfare programs mediated by Direct Benefit Transfer (DBT). As per the IBEF article, e₹ complements digital innovation in India and hence is supporting India’s larger agenda of a cashless economy.

Concerns: Some experts are wary of privacy issues and an increase in financial control through more centralization. According to the Forbes article dated 10, March 2025, the RBI might use the e₹ to urge a further reduction of cash, just as demonetization did before, with the strategic subtext of using the CBDC platform for larger financial policy objectives, engendering surveillance anxieties for the end-user.

Coexistence with UPI: Experts talk about the difficulty in integrating an e₹ with an already well-accepted platform for digital transactions like UPI. The clarification in FAQs of RBI indicates that the e₹ transactions would settle right away when done through CBDC QR, whereas settlements through UPI QR would continue to follow the standard UPI timelines, which the expert feel is a relation complementing non-contending one, that might impact your choice of payment methodology.

vitt’s take..

(vitt – Where India Reads is a space for making Business and finance stories digestible and relevant to India’s digital generation.)

On May 19, 2025, the digital rupee (e₹) was in the pilot stage, with ongoing pilot runs in the retail and wholesale segments. For the user, it promises to be a revolution in payment, giving higher financial inclusion, transaction efficiency, and payments innovation. The feature of offline capability, programmability, and round-the-clock availability fits very well with your different economic needs, and 15 banks offer apps for Android and iOS users under the pilot.

Adoption, privacy, and technical reliability are some factors that need to be taken care of for its success. The Reserve Bank keeps striving to expand the pilot and improve upon the system so that it serves your needs, with e₹ wallets exhibiting no charges, fees, or a requirement of minimum balance, thus allowing a larger set of user-base.

FAQ’s

1. What is the digital rupee, and how does it work for me?

The digital rupee, or e₹, is India’s Central Bank Digital Currency (CBDC), issued by the Reserve Bank of India (RBI). It is a digital form of the Indian Rupee (₹) that provides the benefits of physical cash—trust, safety, and settlement finality—in a digital format.

It is legal tender under Section 26 of the RBI Act, 1934, and can be used for person-to-person (P2P) and person-to-merchant (P2M) transactions. For you, it works like digital cash: you can store it in an e₹ wallet, make payments by scanning QR codes, and even use it offline in areas with limited internet. The pilot phase began on December 1, 2022, and as of 2025, it is still in testing for both retail (e₹-R) and wholesale (e₹-W) segments.

Source: RBI Official FAQ on Digital Rupee

2. How can I start using the digital rupee, and what do I need?

To start using the digital rupee:

- Download the e₹ wallet app from your bank or non-bank provider, available on the Play Store (Android) or App Store (iOS). Currently, 15 banks offer e₹ wallets, including SBI, ICICI Bank, HDFC Bank, and others, with apps like “eRupee by SBI” and “Digital Rupee by ICICI Bank.”

- Link a savings account for onboarding (no minimum balance required) to complete Know Your Customer (KYC) processes.

- Once set up, you can make payments by scanning CBDC or UPI QR codes at merchants and use offline transaction capabilities for areas with limited internet connectivity.

Source: RBI Official FAQ on Digital Rupee, ClearTax – How to Buy and Use RBI Digital Rupee in India

3. Is the digital rupee safe and secure for my transactions?

Yes, the digital rupee is backed by the RBI, ensuring it is as trustworthy as physical cash. It uses robust encryption methods for transaction security and offers settlement finality, meaning transactions are irreversible once completed. Additionally, the RBI has implemented a comprehensive cyber-security framework to protect against fraud and unauthorized access, making it secure for your transactions.

Source: RBI Official FAQ on Digital Rupee

4. How does the digital rupee differ from physical currency, and which is better for me?

The digital rupee differs from physical currency in several ways:

- Form: e₹ is digital and stored in a wallet, while physical currency is in notes and coins.

- Accessibility: e₹ requires a smartphone and internet (with offline options), while physical cash does not, making cash more universal for you if you lack digital access.

- Transaction Timing: e₹ allows 24/7 transactions, whereas physical cash is limited by banking hours for deposits/withdrawals, offering more flexibility for you.

- Security: Both are secure, but e₹ uses encryption, reducing risks of loss or theft compared to carrying cash.

- Privacy: e₹ offers enhanced privacy with regulatory oversight, but transactions are traceable; physical cash is more anonymous, which might suit you if privacy is a priority.

- Programmability: e₹ can be programmed for specific uses (e.g., government Direct Benefit Transfers), a feature not available with physical cash, which could benefit you if you receive subsidies.

Which is better depends on your needs: e₹ is convenient for digital transactions, while physical cash is better for offline, anonymous use.

Source: RBI Official FAQ on Digital Rupee, Financial Express – Explained: What is e-rupee – India’s digital currency

5. How does the digital rupee compare to other digital payment methods like UPI, and should I use it instead?

- Nature: e₹ is a digital currency and store of value, while UPI is a payment system, meaning e₹ can be stored in a wallet like cash, and UPI is for transferring money between accounts.

- Settlement: e₹ transactions settle instantly via CBDC QR, while UPI settlements follow UPI timelines, offering faster settlements for you with e₹.

- Offline Capability: e₹ supports offline transactions, which UPI does not, making e₹ more suitable for you in areas with poor internet.

- Store of Value: e₹ can be stored and used later, similar to cash, while UPI is primarily for immediate transfers.

Whether to use e₹ instead of UPI depends on your needs: use e₹ for offline transactions or when you want a digital store of value, and UPI for quick online transfers. They can complement each other, as noted in the RBI’s FAQ.

Source: RBI Official FAQ on Digital Rupee

6. Are there any costs associated with using the digital rupee, and how does it affect my wallet?

No, there are no charges or fees for using the digital rupee or maintaining an e₹ wallet. It is designed to be cost-effective, similar to physical cash. There is no interest paid on wallet balances, maintaining a cash-like feature, which means your wallet balance won’t earn interest like a savings account but won’t incur costs either.

Source: RBI Official FAQ on Digital Rupee

7. Can I use the digital rupee offline, and is it suitable for rural areas like mine?

Yes, the digital rupee supports offline transactions, which is particularly useful for you in rural or remote areas with limited internet connectivity. The RBI is exploring solutions like telecom connectivity or NFC (Near Field Communication) to enable this feature, making it suitable for your needs in areas with poor connectivity.

Source: RBI Official FAQ on Digital Rupee, EY – What will it take for the Digital Rupee to be widely acceptable in India

8. Is the digital rupee widely accepted, and where can I use it?

As of 2025, the digital rupee is still in its pilot phase and is being tested with a closed user group through 15 select banks and non-banks. While it’s not yet widely accepted across all merchants, you can use it at participating merchants and banks involved in the pilot, such as SBI, ICICI Bank, and HDFC Bank. The RBI is working to expand its acceptance as the pilot progresses.

Source: RBI Official FAQ on Digital Rupee

9. What are the benefits of using the digital rupee for me as a user, especially if I rely on government schemes?

- Financial Inclusion: It can reach underserved populations, especially with offline capabilities, benefiting you if you live in rural areas.

- Transaction Efficiency: Instantaneous transactions available 24/7, offering convenience for you, especially for urgent payments.

- Programmability: Useful for specific purposes like government Direct Benefit Transfers (DBT), ensuring funds are used as intended, which could benefit you if you receive subsidies.

- Security: Backed by the RBI with robust encryption, reducing risks of loss or theft.

- Convenience: No need to carry physical cash, making it easier for you to manage payments.

Source: RBI Official FAQ on Digital Rupee, IBEF – Digital Rupee: Exploring the Future of India’s Central Bank Digital Currency (CBDC)

10. Are there any risks or concerns I should be aware of with the digital rupee, and how are they being addressed?

- Privacy: While it offers enhanced privacy, transactions are traceable, which might raise surveillance concerns for you. The RBI emphasizes a robust cyber-security framework to balance privacy and oversight.

- Technical Reliability: The system must be secure and reliable, especially for offline transactions, to prevent fraud. The RBI is exploring solutions like telecom connectivity for offline transactions, but technical challenges could undermine trust if not addressed.

- Adoption: Widespread use depends on user education and trust-building, as it’s still in the pilot phase. The RBI is working on expanding the pilot to address this.

Source: Forbes – A 2025 Overview Of What You Need To Know About The Digital Rupee, RBI Official FAQ on Digital Rupee

11. Can I store the digital rupee like cash, and does it earn interest?

Yes, you can store the digital rupee in your e₹ wallet, serving as a store of value like cash. However, no interest is paid on wallet balances, maintaining a cash-like feature, which means it won’t earn interest like a savings account but won’t incur costs either.

Source: RBI Official FAQ on Digital Rupee

12. How does the digital rupee support government schemes, and will it affect my subsidies?

The digital rupee can be programmed for specific purposes, such as Direct Benefit Transfers (DBT), interest subvention, and lending, ensuring funds are used as intended. This could benefit you if you receive subsidies, as it reduces leakage and ensures timely delivery. For example, funds can have expiry dates or geo-location restrictions, enhancing efficiency for government schemes.

Source: RBI Official FAQ on Digital Rupee, Wikipedia – Digital rupee

13. What happens if I lose my phone with the digital rupee wallet, and how can I recover it?

If you lose your phone, you can contact your bank’s customer support through the e₹ wallet app or their customer care to report the loss and request assistance. Since the wallet is linked to your savings account, recovery processes are similar to those for lost bank cards, ensuring you can regain access with proper verification.

Source: RBI Official FAQ on Digital Rupee, ClearTax – How to Buy and Use RBI Digital Rupee in India

14. Is the digital rupee environmentally friendly compared to physical cash?

Yes, the digital rupee reduces the need for printing and transporting physical notes, making it more environmentally friendly. This could appeal to you if you care about sustainability, as it lowers the environmental costs associated with physical currency production, estimated at ₹49,848,000,000 in 2017 for security printing, as per Wikipedia.

Source: Wikipedia – Digital rupee

For more such updates on Daily news, Business, startups and Loan Management subscribe to vitt – Where Bharat Reads….